The purpose of a balance transfer is to transfer your balance from a credit card with a high APR to a credit card with a lower APR. There are many credit cards that have 0% APR balance transfer offers for as many as 21 months. For savvy consumers, taking advantage of these offers may be a great way to borrow money, all interest-free (for a wedding, house, car, etc.). Here in this post, I will teach you a few strategies of how you can possibly get cash from a 0% APR offer.

1. Balance transfer checks

Chase, Barclay, Citi, and other banks very often send balance transfer checks to their cardholders. These checks can be written out to your name and deposited into your bank account. If you have these checks then that would be the easiest and straightest way to turn a balance transfer into cash. Wells Fargo usually offers balance transfer checks even for new cardmembers as well.

If you have two or more checks from one issuer, then you can maximize them by writing out the first check for the full allowable amount. Then, once the check clears, you can balance transfer that balance to a credit card that allows balance transfers only. This will bring the first credit card back to a zero balance. Then, write out the second check for the full allowable amount and repeat for as many checks as you have.

If you don’t have checks, you can sometimes call the bank and request checks. Sometimes, the bank may even offer to make an ACH deposit straight into your bank account.

2. Swipe and save

I recently assisted a store owner who was looking to expand his store. He wanted to borrow $60,000 cash from 0% APR credit cards. The company swiped about $40,000 a month on credit cards and paid it up when it was due. What I advised him was that instead of paying his balance with cash, he should rather swipe his business purchases on a 0% APR card, pay that slowly, and save the cash on hand to use for his planned store expansion.

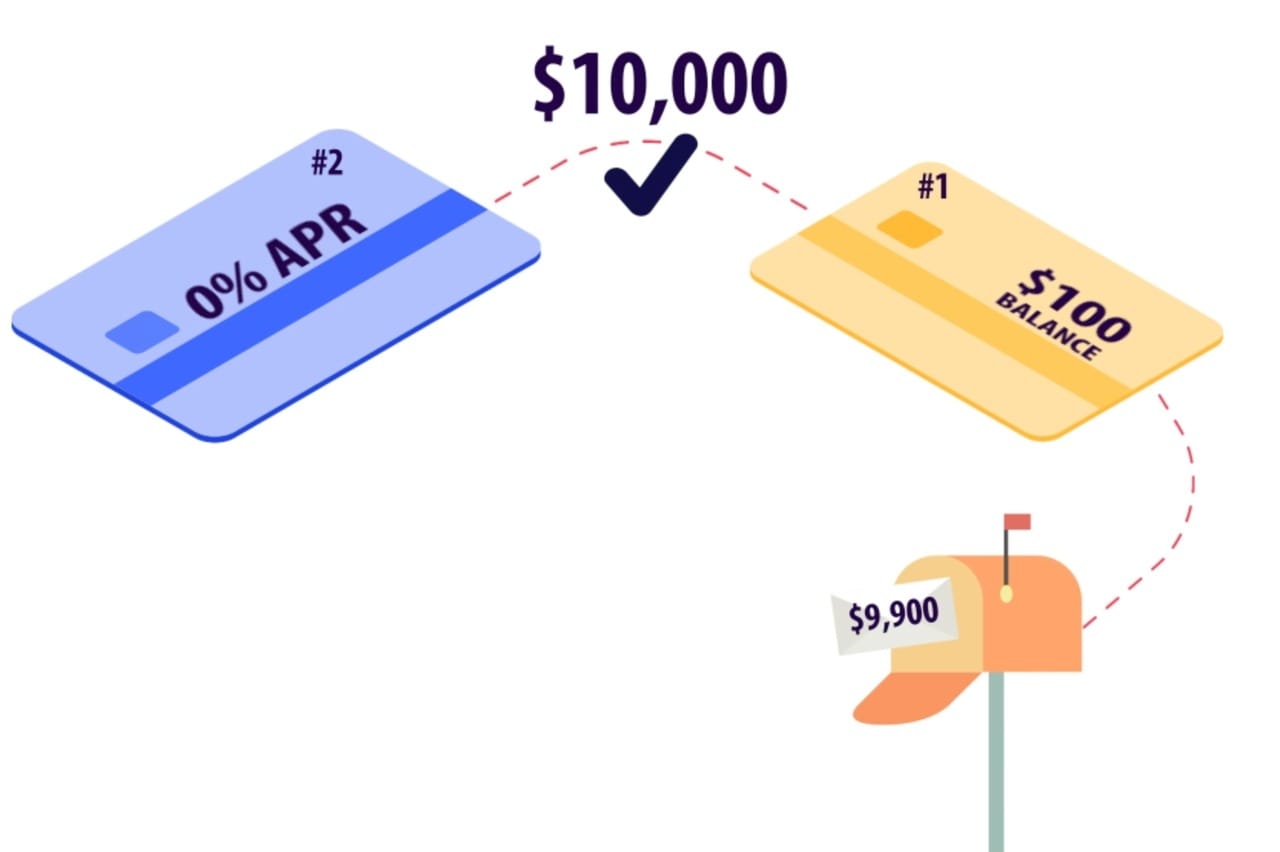

3. Overpay and refund

This strategy is to overpay a credit card balance and later request a refund.

For example, if you have a $100 balance on credit card # 1, then go ahead and ask credit card #2 (the credit card that has the 0% APR balance transfer offer) to go ahead and balance transfer $10,000 dollars from credit card #1 (which really only has a $100 balance). Credit card #1 will receive a payment from credit card #2 for $10,000, leaving you with an extra credit of $9,900. Then you can call credit card #1 and request them to refund the $9,900 since you “by mistake” added zeros when you made the payment (balance transfer).

Credit card #1 will then offer a check refund for the amount of $9,900.

In the last few years, this has become very tough as banks started to either refuse these types of payments, or they may close your account after you request a refund (usually only if this happens multiple times). In order for you to up your chances of being successful, I recommend you choose for credit card #1:

- A bank that you don’t care so much about if they would close you down.

- Make sure to have a small balance on the credit card, as that will help for the bank not to decline the balance transfer payment.

4. Pay friends using Paypal or Venmo

PayPal and Venmo, among other companies, allow you to pay friends using a credit card for a fee of about 3%. But these transactions can sometimes be flagged by the bank as cash advance and may not count as spend for 0% APR (like with Amex). Also, if you do this too often, PayPal and Venmo will most likely shut you down (you can search Google for other smaller P2P payment platforms that work better for this type of spend, with less issues. The info is carefully guarded so I cannot post the names publicly).

5. Use Famigo’s Bravo Pay App for sending payments

Famigo, formerly Bravo Pay, has a platform for sending person-to-person payments via mobile phone on iOS and Android. Payments sent via this app have a fee of approximately 3% – 3.6%. Currently, no major credit card issuer will charge cash advance fees for payments made through Bravo Pay, and Bravo Pay allows a large volume to be sent with little to no risk of a shutdown.

Conclusion

If you ever are in need of a personal loan and get rate quotes of 10% APR or more, remember this post. Yes, you can take out cash from credit cards with 0% APR for up to 21 months. In my opinion, it’s a no-brainer for anyone who has great credit, to take any other personal loan rather than cash out a 0% APR balance transfer credit card.

Simple question. Would you rather save $900 or lose $900? Anyone with a bit of brains would say they’d rather save. Yet, you have that chance multiple times a month an...

![Medical Collections Under $500 Removed From Credit Reports [Effective April 11]](https://helpmebuildcredit.com/wp-content/uploads/2023/05/post-on-medical-collection-under-500-removed-from-credit-report.png)

![Start The Year Interest Free -The Top Ten 0% APR Credit Cards [2023]](https://helpmebuildcredit.com/wp-content/uploads/2023/01/post-on-top-0-apr-cards.png)

How do the balance transfer checks work? Do the banks give a check to pay off the other cc which I can then deposit in my checking account?

It would be a normal check which you can write out to whoever you want, even yourself.

Thank you very much for posting the memo of Balance transfer checks. I got an promo from my Venture card for 0% APR on balance transfers and gave me the option for receiving the funds in a check what was very helpful in my current financial status and after reading this memo it gave me clarity how it works.